Now that you have a basic understanding of Medicare Parts A and B you may have more questions than answers.

(If you skipped our Part A section or Part B section we recommend you read them first before continuing)

What do I pay for prescriptions?

How much can I expect to pay out of pocket?

How will I pay the Part A Deductible(s)?

Can I afford an extended hospital stay with Medicare Part A only?

Let’s answer a few right now!

Your out of pocket cost are UNLIMITED with Medicare Part A and Part B. Medicare Supplement plans can dramatically lower or eliminate the risk of unmanageable health bills.

Parts A and Part B DO NOT cover prescription medication. Part D prescription plans or Medicare Advantage plans (Part C) with Prescription Drug coverage can help you minimize this cost.

Supplemental Plans cover your Part A and Part B deductibles and coinsurance. How much of the out of pocket costs depend on what plan you choose.

Now for some good news!

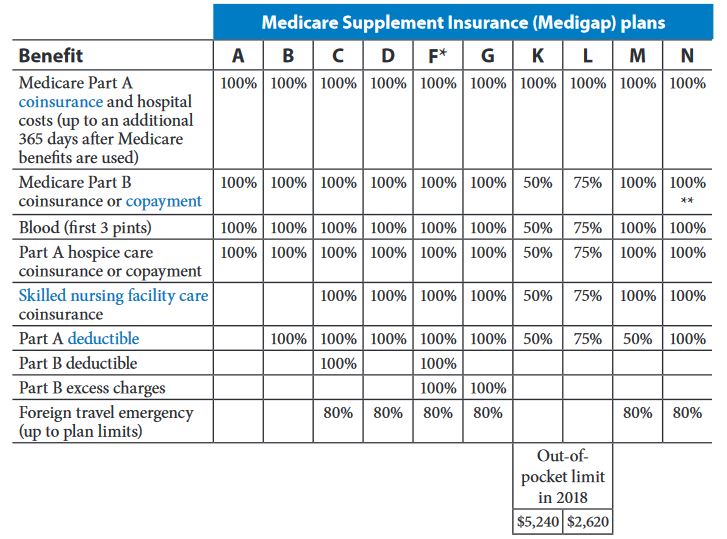

While there are many carriers who offer Medicare Supplements, the good news is the plan coverage doesn’t change between carriers. This makes shopping much easier than many other types of insurance. The major factors between companies we look at is their claims paying ability (financial rating), customer service ratings, application fees, and overall company history.

What Supplement plan should you choose?

The most popular Medigap plan for many years has been Plan F. Plan F pays for 100% of your Part A&B deductibles, Co-insurances, and Co-payments. In addition it also covers Part B excess charges and provides emergency medical for foreign travel.

Lower cost alternatives should you consider.

Plan G is a great alternative the only difference between Plan F and Plan G is the Part B deductible for 2018 the deductible is $183.00 annually. That means when to the doctors office you will be responsible for the first $166.00 (not each time you go, or each doctor you see). Now the concern is what if the deductible continues to rise over the years? In 2016 the rate went from $147 in 2015 to $166 for 2016, but from 2017 to 2018 the deductible didn’t change. It may not sound like much, but considering it’s an average of 8.4% increase every year it’s a valid concern. I don’t think I have to go into great detail about the compounding effect of 8.4% increases and what they would mean to you after 20years. While the increases should be a concern to everyone in general, it shouldn’t be a big factor in deciding between the two plans. Since there are no free rides, the insurance carrier will adjust their premiums to compensate for the increases each year.

Plan N is also a good alternative the difference between Plan F and Plan N is it doesn’t cover the Part B deductible or the excess charges. Now you may be asking yourself what are excess charges and what’s the big deal? When you see a doctor they may accept medicare “assignment” or they may not accept the assignment amount and can charge you more. You would be responsible for the difference between the assignment amount and the amount the doctor charged. Keep in mind that in either case the doctor must participate with medicare. If the doctor doesn’t participate in Medicare you will be responsible regardless of your plan selection.

Below is a list of the plan types and their differences directly from the 2018 Official Medicare Guide

A High Deductible Plan F may be available in some states

** Plan N pays 100% of the Part B coinsurance, except for a co-payment of up to $20 for

some office visits and up to a $50 co-payment for emergency room visits that don’t result in

an inpatient admission.

Here are 5 great reasons you should consider signing up for Medicare Insurance with Cunningham Life Insurance Agency

1) We Guarantee the lowest priced Medigap, Medicare Advantage and Drug plans allowed by law.

- Prices are regulated so no one (including insurance providers) can offer plans for less than Cunningham Life Insurance Agency

2) We provide easy-to-use online tools

- Request a quote and communicate via email

- Educational information at your fingertips

- Simple online and phone applications

3) We offer free agent support before, during and after your plan enrollment

- We help you select the right plan for your budget

- We guide you in signing up for a plan, by the method your most comfortable with.

- We continue to be your agent long after the enrollment so you’ll have an independent and trusted voice to explain your coverage.

4) We never charge you for our services!

- All services at Cunningham Life Insurance Agency are free. If we help you sign up, we receive a commission from the insurance provider. This commission will never come out of your monthly premium or be charged to you.

5) You will be supporting a family owned and operated business

- You will never be a number in the crowd with us

- We truly appreciate your business